Introduction

Losing a loved one is one of life’s most difficult experiences. Beyond the emotional pain, there’s often a heavy financial burden—especially when it comes to funeral expenses, which can easily run into the thousands of dollars. Naturally, many people begin to wonder whether any of these costs are tax-deductible and if there’s a way to ease the financial strain through a tax break.

In this updated guide, we’ll walk you through everything you need to know about funeral and burial expenses and how they’re treated under current tax laws. We’ll explain the latest IRS rules, clarify how funeral costs may be handled through an estate or trust, and explore real-life situations to help you understand what is—and isn’t—allowed. Whether you’re managing final affairs or preparing for the future, this guide will help you navigate your options with clarity and confidence.

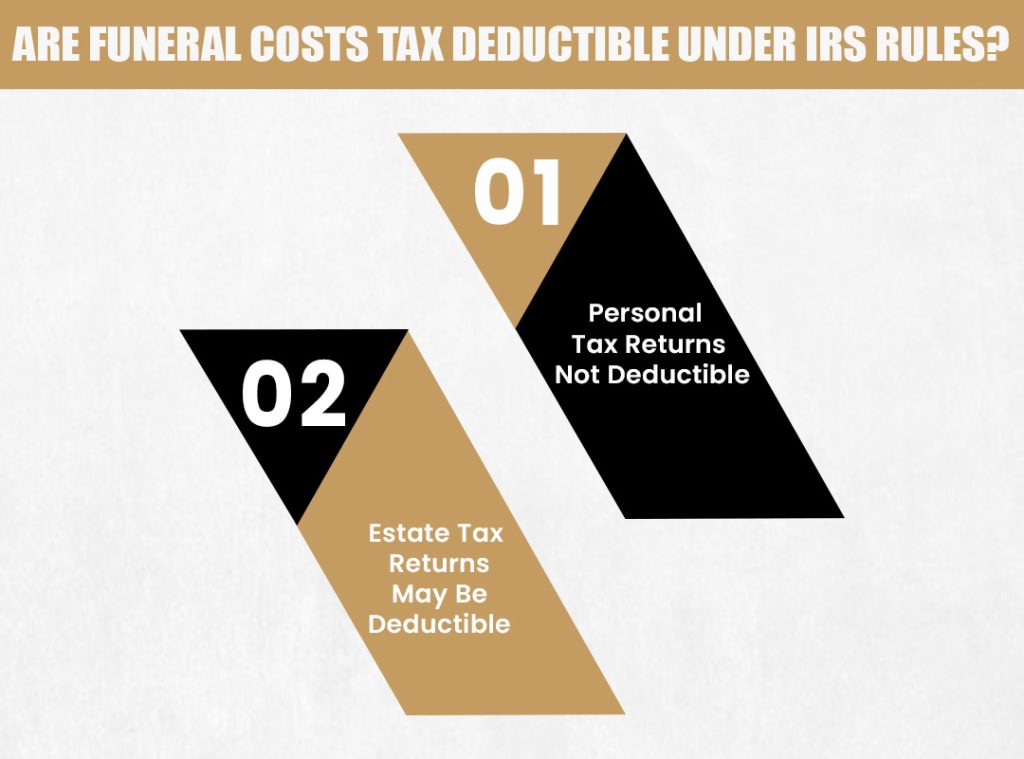

Are Funeral Costs Tax Deductible Under IRS Rules?

Many people ask, “Are funeral costs tax deductible?” The short answer is: Not for individuals.

Personal Tax Returns: Not Deductible

According to IRS rules, you cannot deduct funeral expenses on your personal income tax return. This means if you paid for a loved one’s funeral out of your own pocket, the IRS does not allow you to claim those costs as a deduction.

Get Free Quotes

Customized Options Await

Estate Tax Returns: May Be Deductible

However, funeral costs may be deductible if they are paid by the estate of the deceased. In this case, the estate can claim these costs on Form 706 (Estate Tax Return), which is filed by the executor of the estate.

What’s the Difference?

- Personal deduction: For people who pay out of pocket not allowed.

- Estate deduction: For expenses paid by the estate may be allowed under certain IRS rules.

For more information, see IRS Publication 559, which provides guidance for survivors, executors, and administrators.

When Funeral Expenses May Be Deductible on Form 1041

Many ask, “Are funeral expenses deductible on Form 1041?” The answer is no but there’s an important detail to understand.

Form 1041 vs. Form 706

- Form 1041 is used to report estate income, like interest or dividends the estate earns after someone passes.

- Funeral expenses are not deductible on Form 1041.

However, estate tax funeral costs may be deducted on Form 706, which is the federal estate tax return.

When Does Form 706 Allow Funeral Deductions?

To deduct funeral expenses on Form 706, the following must be true:

- The estate is large enough to be subject to federal estate tax.

- The executor of the estate files Form 706.

- The funeral expenses were paid by the estate, not reimbursed by insurance or any other party.

For details, see the official IRS Form 706 Instructions.

Are Any Funeral Costs Tax Deductible for Individuals?

Many people wonder:

“Can you claim a funeral on your taxes?”

“Can you deduct funeral expenses on your taxes?”

“Is funeral expense tax deductible?”

In most cases, the answer is no.

No Personal Tax Deductions

The IRS does not allow individuals to deduct these common funeral expenses:

- Cremation

- Burial plots

- Funeral services

- Transportation or flowers

These costs, even though they can be high, are considered personal expenses, and they are not tax-deductible on your regular tax return.

Rare Exceptions

- If the funeral is for an employee and paid by a business, it may be considered a business expense (rare).

- If you are the executor of an estate, some costs may be deductible by the estate (not you personally) through Form 706, not your own return.

Special Considerations for Prepaid and Trust-Based Funeral Expenses

Many people ask if prepaid funeral expenses are tax deductible especially when using a funeral expense trust. Here’s what you need to know.

What Is a Funeral Expense Trust?

A funeral expense trust is a legal agreement where money is set aside ahead of time to cover funeral costs. This money is usually held in a trust by a funeral home or financial institution and used when the person passes away.

Are Prepaid Funeral Expenses Tax Deductible?

No. Even if you pay funeral costs in advance through a trust, they are not deductible on your personal tax return. The IRS still treats them as personal expenses.

Why Use a Funeral Trust?

While there’s no personal tax deduction, funeral trusts can:

- Reduce the total value of your estate, which may help with Medicaid planning.

- Ensure funds are available for funeral costs, reducing the burden on loved ones.

Some legal and financial experts recommend prepaid funeral plans for estate or elder care planning, but not for tax savings.

Are Funeral Expenses Tax Deductible in California?

You might wonder, “Are funeral expenses tax deductible in California?” The answer is similar to federal law.

California Follows Federal Rules

In California, funeral expenses are not tax deductible on personal income tax returns. The state follows the same rules as the IRS.

California and Estate Tax

- California does not have a state estate tax.

- Therefore, there are no estate-level deductions for funeral costs beyond federal rules.

Help for Low-Income Families

California may offer funeral assistance programs at the county level for low-income individuals or families, but these are not tax deductions. Instead, they may provide direct financial aid or funeral cost help.

Check with your local county or health and human services office for available support.

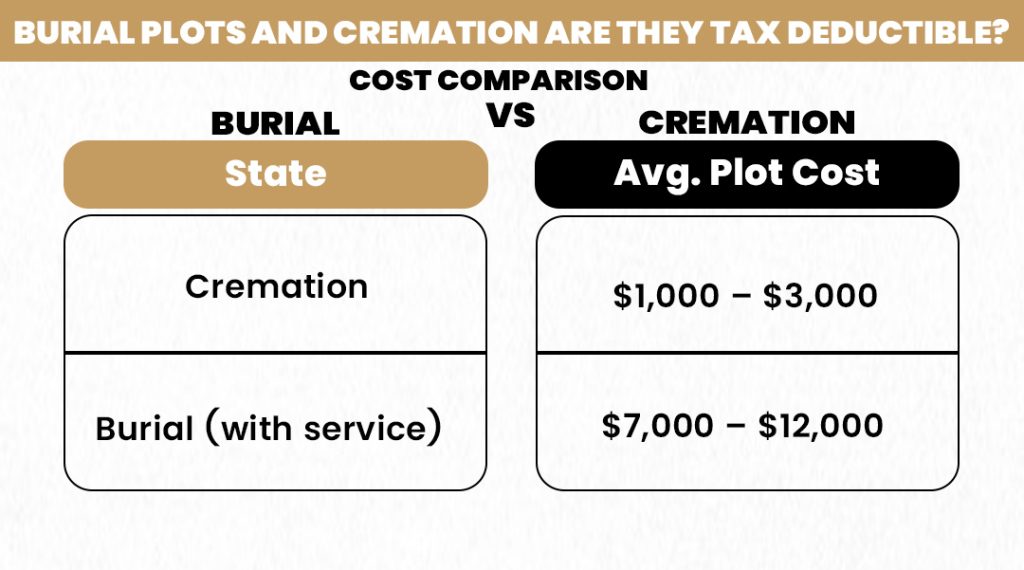

Burial Plots and Cremation Are They Tax Deductible?

A common question is:

“Are burial plots tax deductible?”

“Is cremation tax deductible?”

The simple answer: No, not on personal tax returns.

Not Deductible for Individuals

If you pay for:

- Burial plots

- Cremation services

- Caskets or urns

you cannot deduct these costs on your individual tax return. These are considered personal expenses by the IRS.

Possible Deduction for Estates

If the estate pays for cremation or burial, these costs may be deductible but only on Form 706 (federal estate tax return), and only if the estate qualifies to file it.

This shows the financial impact of final arrangements and why people often ask about tax deductions.

Final Tax Deductions What to Know When Settling an Estate

When someone passes away, handling their taxes can get confusing. Many people ask how final tax deductions work especially when it comes to total funeral expenses. Here’s a breakdown of the key forms and what each one covers.

1. Final Individual Tax Return Form 1040

This is the last personal tax return filed for the person who passed away.

- It covers income they earned up until their date of death.

- Funeral expenses cannot be deducted here.

- Only standard personal income items (wages, Social Security, etc.) are reported.

2. Estate Income Tax Return Form 1041

This form reports any income the estate earns after death like bank interest, rent from property, or dividends.

- It is filed by the estate executor.

- Funeral expenses are not deductible on Form 1041.

3. Estate Tax Return Form 706

This is used only if the estate is large enough to owe federal estate tax.

- Funeral expenses may be deductible on this form but only if paid by the estate.

- Must not be reimbursed by insurance or others.

Why Tracking Total Funeral Expenses Matters

Even though most people can’t deduct funeral costs, it’s still important to track the total funeral expenses:

- It helps with estate accounting.

- It’s required documentation if filing Form 706.

- It can support Medicaid or probate filings, if needed.

Keeping clear records makes estate settlement smoother and ensures deductions (if allowed) are properly claimed.

Conclusion:

Funeral costs can be emotionally and financially overwhelming. One key takeaway is this: funeral expenses are not tax deductible on personal income tax returns. No matter how much you spend on cremation, burial, or services, the IRS treats these as personal costs.

However, if you are managing an estate, certain funeral expenses may be deductible but only on the estate tax return (Form 706), and only under specific conditions.

To avoid costly mistakes, it’s a good idea to consult a CPA or estate attorney, especially if you’re the executor or handling estate finances.

Final Tip: Stay informed. Knowing the rules ahead of time can help you make smarter financial decisions during a time that’s already hard enough.

Frequently Asked Questions (FAQ)

Q: Are funeral expenses tax deductible in California?

No, funeral expenses are not tax deductible in California. The state follows federal IRS rules.

Q: Can you write off funeral expenses on your taxes?

No, you cannot write off funeral expenses on your personal tax return; they are considered personal costs.

Q: Are prepaid funeral expenses tax deductible?

No, prepaid funeral expenses are not tax deductible on individual returns, even if paid in advance.

Q: Can I deduct funeral expenses for my husband?

No, you cannot deduct your husband’s funeral expenses on your personal taxes; they are not allowed by the IRS.

Q: Is cremation tax deductible?

No, cremation costs are not tax deductible on personal returns, unless paid by a taxable estate and claimed on Form 706.